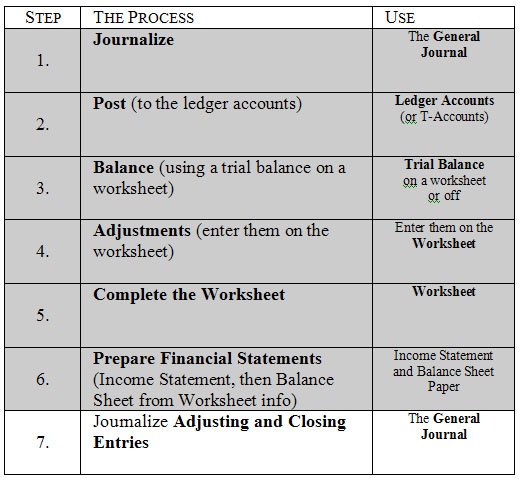

You have now learned every step in the accounting cycle except the last. This is where we journalize our adjusting entries (we just put them on the worksheet before), and where we perform closing journal entries.

Once we have journalized our adjustments, we perform closing entries.

Closing entries are exactly what the name suggests: they are journal entries that close off the accounts for this accounting period, and prepare them to run through a brand new accounting cycle in the next accounting period.

Not all accounts are closed. There are two kinds:

- Permanent Accounts (from cash down to Capital)

- Temporary Accounts (drawings, revenues, and expenses)

The image of the same old Worksheet we’ve been using below, shows us

which accounts need to be closed. Pay careful attention to these values, they

are the same as the ones we will use in our example of how to do closing

entries later in this lesson.

Why

Do We Close Temporary Accounts?

If you haven’t noticed yet, (from either trying to complete the equity section of the Balance Sheet, or from trying to complete the Balance Sheet section of the Worksheet) the Capital account does not tell us the current value of total Owner’s Equity. It only gives us the value for the first day in the accounting cycle.

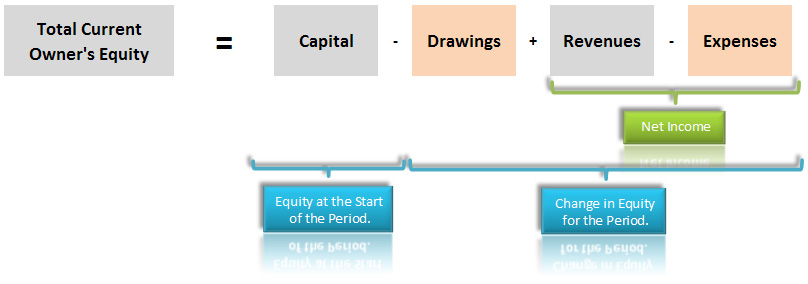

This is because we took the Owner’s Equity account and broke it down into four types of equity accounts: Capital, Drawings, Revenues, and Expenses. All equity transactions have been channelled into these accounts. To find the current total owner’s equity, one must put them all together.

That is:

This is exactly what closing

entries do. They combine all drawings, revenues, and expenses, and put

the net value back into the Capital account for the start of the next accounting

period.

The process is very simple. There are four easy steps.

Close:

- All revenue and expense accounts with a credit balance

- All revenue and expense accounts with a debit balance

- The Drawings account to Capital

*

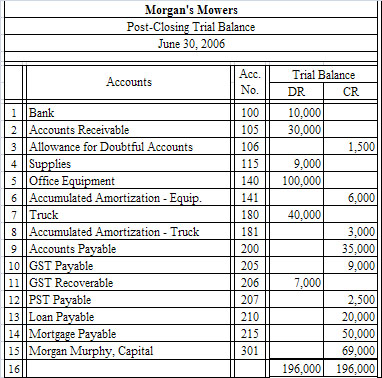

After we close, we prepare a trial balance to ensure that we’ve closed

properly. This is called a Post-Closing Trial Balance. The Post-Closing Trial

Balance for our example above looks like this:

Note: nothing appears after the Capital account, because all the balances are zero! We have closed them out and reset them to zero for the next accounting period.

Click below for a completed worksheet and blank journal paper. Use this Excel file to complete the closing entries for this company.

NOTE: If you prefer, you can do it by hand. You can print out your own accounting paper at any time by using this file:

Answer

Answer

Click below for the answer to the exercise above.