The Periodic Method of Merchandise Accounting

Part IV: The Financial Statements

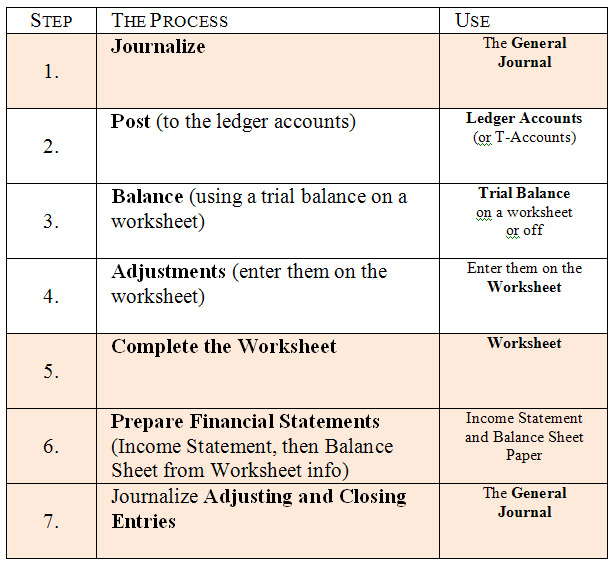

If you recall, we are examining the changes in the accounting cycle between a service business, and a merchandise business.

The areas that have variation are highlighted in colour below. In this lesson we’ll discuss the changes to the financial statements.

2. Changes

to the Balance Sheet.

Besides the line for the Merchandise Inventory Account as shown below (in current assets), there are no changes to the Balance Sheet.

3.

Why are we changing the Income Statement?

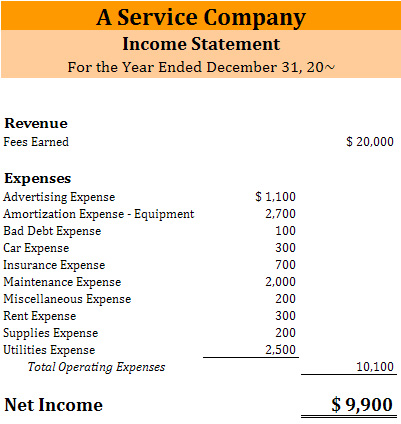

It is now time to change the Income Statement. Previously, we used a two column Income Statement like the one below.

Our needs however, have surpassed this simple format. Similar to the reasons

for changing the Balance Sheet, there are three major reasons for changing

the Income Statement:

- We have several contra-accounts that need to be shown and sub-totalled on the Income Statement. This requires a Balance Sheet with multiple columns.

- As we begin to require more specific information for analysis and reporting, we need to categorize, and classify certain accounts into particular groups, so as to clearly present important information.

- Lastly, now that we are working with businesses that sell goods, we have the addition of a new type of expense: the Cost of Goods Sold expense. This requires a new section on the Income Statement.

In this lesson, we shall learn how to make a formally presented Income Statement for a merchandise business.

4. How do we make the new Income Statement?

There are three really big changes:

1. Accounts are classified more specifically

2. There are three columns

3. There is a new section for the Cost of Goods Sold

We now will discuss each of these in turn.

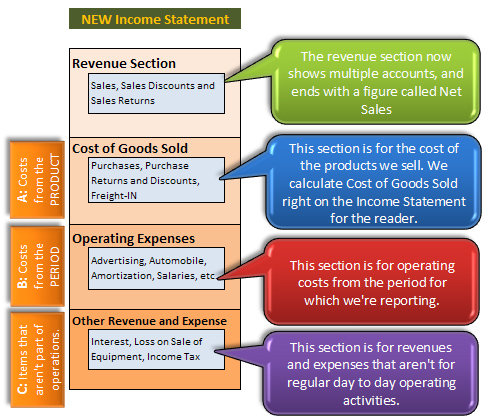

A. Accounts are classified more specifically

Instead of the two parts on our Income Statement as show above (Revenues and

Expenses), we now have four. Mainly this is to track and present separate

types of costs.

Below you can see what each of these sections is, and why they exist:

As you can see, we have a section for

1. Revenues,

2. Product Costs (i.e. inventory sold, or Cost of Goods Sold)

3. Period Costs (for regular costs from running our business – in other words – operating expenses), and

4. Non-Operating Revenues and Costs that are not routine or operational in nature.

Non-Operating Items

This is the newest concept. These non-operating expenses are for items that do not occur regularly, and therefore are shown separately so as not to skew expense levels for the operating expense section.

When a reader looks at operating expenses on an Income Statement, the section should reflect costs that are normal and recurring in nature (i.e. the reader would expect to see them again next year).

Non-operating revenues and expenses are either:

- Non-recurring (a loss or gain from the sale of an asset),

- Exceptional (acts of God),

- Beyond the control of management (like taxes), or

- Not operational in nature (like interest – interest is a financing/borrowing decision, subject to interest rates, which are also beyond the control of management).

Therefore, these costs are separated out from regular operating expenses.

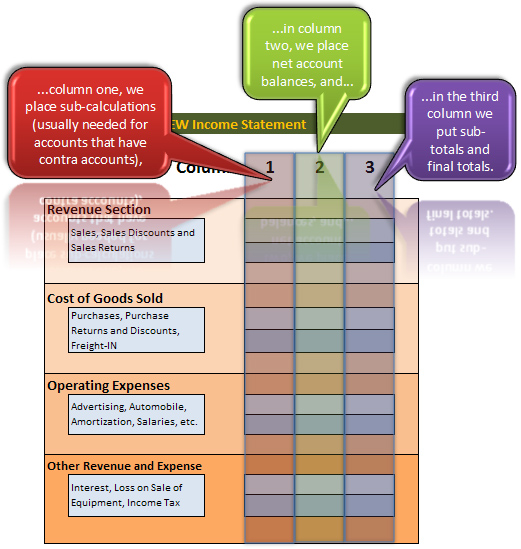

Just like the new Classified Balance Sheet, the new Income Statement has three columns, with very similar purposes as shown below:

C. There is a new section for the Cost of Goods Sold

This is the most difficult section of the four-part Income Statement. Let’s

go through it step by step. When you are ready, click ‘Next’ below

to begin.

5. What the new Income Statement Tells You

This new Income Statement is useful for a variety of reasons, just the like

the new Classified

Balance Sheet. When you’re ready, click ‘Next’ below

to see why.

Using the worksheet and blank template found in the Excel file below, produce a formal Income Statement.

NOTE: If you prefer, you can do it by hand. You can print out your own accounting paper at any time by using this file:

![]() Answer

Answer

The answer to the above exercise can be found by clicking the link below: