The Periodic Method of Merchandise Accounting

Part I: Journal Entries

By Jeff Boulton

In this entire topic, the approach will be as follows:

You will learn accounting for a merchandise business by being shown only what differs between a service business and a merchandise business.

To re-emphasize, you will find that differences only arise when the cost of merchandise inventory is involved.

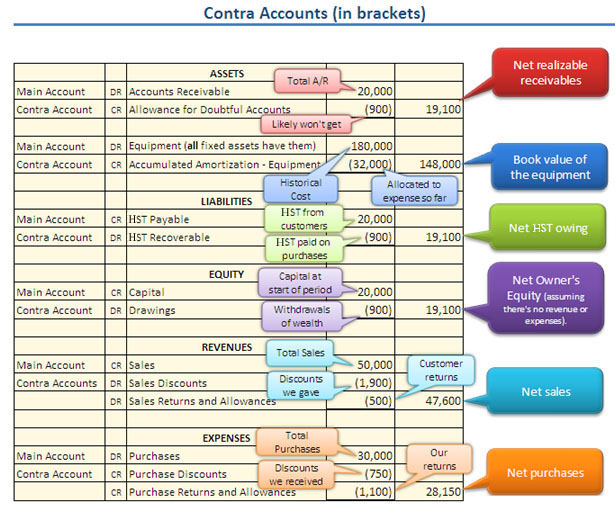

Below is the accounting cycle. Accounting methods differ in some way between a service business and a merchandise business for all of the highlighted steps below.

We will look at one varying part of the cycle per activity. In this activity,

we will begin by looking at Journalizing.

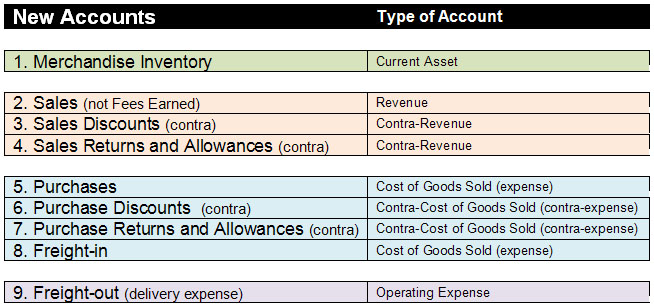

To track the purchase, shipment, and cost of merchandise, new accounts are needed.

They are as follows:

We now will examine what journal entries look like for each of these new accounts.

You should refer back to this chart frequently.

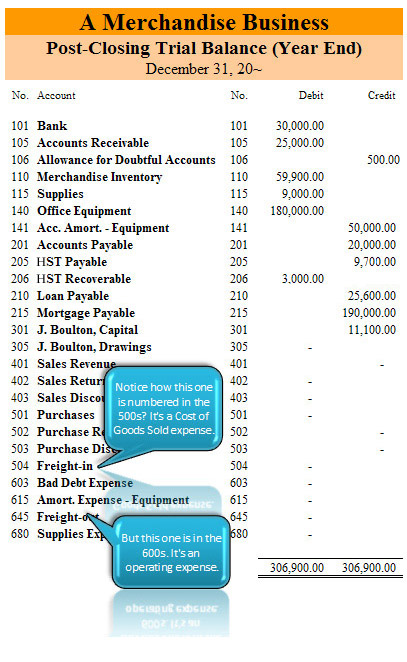

A typical chart of accounts for a merchandise

business will resemble this Trial Balance (note the numbers for operating

expenses are 600s, and cost of goods sold are 500s – unlike some

service businesses whose expenses are all 500s).

1. Merchandise Inventory

Merchandise

Inventory is our new current

asset account. Under the periodic method of accounting for a merchandise

business, it is only touched during closing

entries. Thus, the balance inside shows inventory at the beginning of

the accounting period.

It’s position is usually as shown in the partial Balance Sheet below.

If you have bought inventory, instead of going to the Merchandise Inventory

account it goes to the Purchases account.

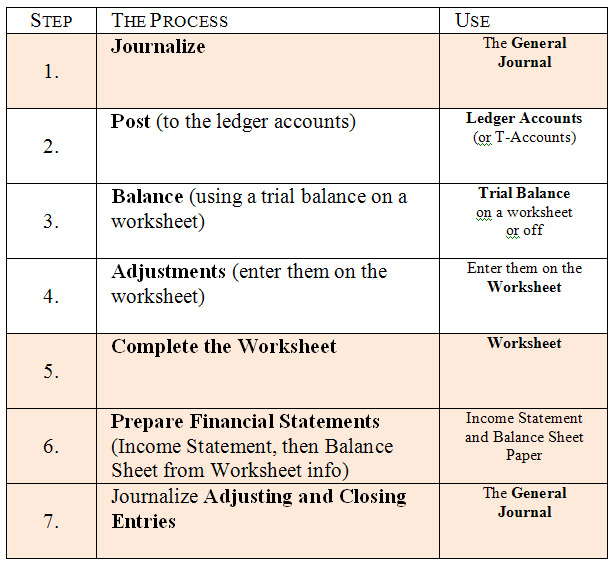

This isn’t really new. It’s just revenue. One should note though,

that instead of Fees Earned, revenue in a service business is often referred

to as Sales.

Since HST applies to most services and almost all goods, there is little new here. Observe the following illustration for revenue of $1,000 plus applicable taxes.

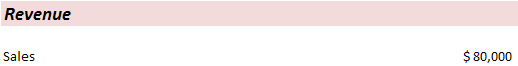

In adjustments lesson for a service business, we introduced the concept of contra accounts. Let’s take a moment and revisit this concept, as many of our new accounts in this unit are contra accounts as you may have noticed above.

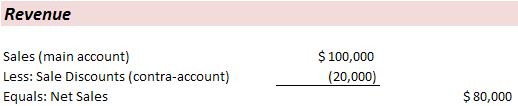

A contra account is shown together with its main account on the financial statements. When added together, the two accounts produce the total net value for that account.

Contra accounts are kept separate in the chart of accounts because if they were combined with the main accounts, information would be lost.

What does this mean? Well, take this example: Assume the following information:

So, this company is making $100,000 in sales, but is giving back 20% of them in discounts. That’s way too much! Management would want to change this when they discovered this problem.

However, if you combined the contra account and the main account, this information would be lost. All the Income Statement would show is Sales of $80,000, as follows:

Below is a list of all the contra accounts you’ll encounter in this course; you’ve seen it before. Once again, this is important to know, because many of the new accounts we will learn about to do Merchandise Accounting are actually contra accounts.

End of Review

Back to the new accounts for a merchandise business.

Sales discounts operate in exactly the same way as before. Below assume $1,000 of revenue is earned with a 1% discount on the total owing. The entries for this would be as follows:

4. Sales Returns

and Allowances

As we have all experienced, at times some customers will purchase things they wish to return for a variety of reasons.

These returns are not removed from the Sales account, for the same reasons as explained in the contra-accounts review above.

Users of the financial statements would want to see the size of Sales and compare it to the size of Sales Returns. If a lot of Sales were being returned, this could suggest poor quality, which may necessitate a change in suppliers.

The journal entry for the return of a $100 of revenue looks like this:

When purchasing items OTHER than inventory, journal entries are the same as in a service business. Observe this purchase of supplies for $500 plus HST:

But when we’re buying MERCHANDISE for RE-SALE, the journal entry for

$500 plus HST looks like this:

Since services businesses do not have inventory, there is no comparable entry

for the service side on the left.

It is important to understand that all purchases of merchandise are debited to the Purchases account. Though inventory on hand is a current asset (short-term), the Purchases account is NOT an asset account. It is a Cost of Goods Sold account (an expense).

The reason will become clearer later, but be sure not to touch the merchandise inventory account when you buy inventory. Remember: the only time the Merchandise Inventory account is changed is during closing entries.

It is also important to note that just because you have made a purchase, doesn’t mean it goes to the Purchases account. Only if it is a purchase of Merchandise Inventory (i.e. goods for re-sale), do you debit the Purchases account.

Purchase discounts are dealt with in exactly the same way. The discount appears on the same side as cash, and the discount rate reduces the amount of cash that changes hands. Similarly, the discount is only recorded when payment is made in cash, as that is the only time when you are certain payment is made within the discount period.

7. Purchase Returns

and Allowances

Similar to Sales returns and allowances, when we return merchandise purchased, we credit the contra-cost of goods sold account called Purchase Returns and Allowances. We DO NOT reduce the Purchases account. We want to compare our original purchases to our returns.

The journal entry looks like this

Getting merchandise ordered into our hands is considered to be part of the

cost of obtaining the merchandise. Therefore, freight-in (freight charges

for merchandise goods shipped IN), is a Cost

of Goods Sold account.

Conversely, Freight-out (freight charges for sending merchandise OUT to customers) is not a Cost of Goods Sold. It is part of running the business, and is therefore an operating expense.

The entry to record a freight-in charge of $200 is as follows.

Freight-out is NOT a Cost

of Goods Sold. It is an operating

expense for a service business and a merchandise

business. It is the cost of shipping items to customers.

The entry would look like this:

Record the following journal entries in the paper provided (MS Excel 2003).

NOTE: If you prefer, you can do it by hand. You can print out your own accounting paper at any time by using this file:

![]() Answer

Answer

Try the practice first!