The Perpetual Method of Merchandise Accounting

Part VII: Completing the Accounting Cycle for the Perpetual Merchandise Business

By Jeff Boulton

| Contents: |

| Introduction - The last changes |

| 1. The Worksheet |

| 2. The Income Statement |

| 3. Closing Entries |

| Practice Exercise |

The Worksheet, Income Statement, and Closing Entries

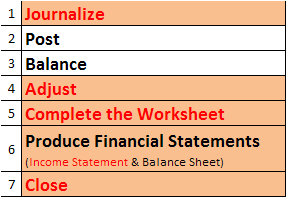

If you recall, we are only looking at what differs between the Periodic

and Perpetual

methods of accounting for a merchandise

business, as indicated by the highlighted steps in the accounting cycle

pictured below:

We have examined journalizing. In this lesson we will explore the remaining

steps.

The Worksheet (and

Adjustments)

If you remember, the perpetual method of accounting for a merchandise business continuously keeps the merchandise inventory account up to date.

Purchases of inventory are entered into the Inventory account, when items are sold they are removed from the inventory account and debited directly to the Cost of Goods Sold expense account.

As a result, the worksheet is essentially the same as for a service business except for a couple merchandise accounts. Observe:

Now that we have an account for the Cost of Goods Sold expense, and our merchandise inventory account is updated continuously, we no longer need to show the calculation of Cost of Goods Sold on the Income Statement.

The entire section of Cost of Goods Sold condenses to a single line. When you are ready, click next below to see.

Closing entries

requires no update to inventory, as the inventory account is always up to

date.

This means that closing entries follow exactly the same four step process that they do for a service business. To see, click next when you’re ready.

Click below to complete the complete the accounting cycle from the worksheet on.

NOTE: If you prefer, you can do it by hand. You can print out your own accounting paper at any time by using this file:

![]() Answers

Answers

Here is the answer key for the above practice exercise.