The Perpetual Method of Merchandise Accounting

Part VI: Introduction to the Perpetual Method

By Jeff Boulton

As you may recall from the introduction to accounting for a merchandise

business, there are two methods:

We now will learn how the perpetual method of accounting, varies from the

periodic method.

Essentially, you will find that the two methods differ only when the “costing” of inventory occurs.

Basis

for the Perpetual Method

The name perpetual is a reference to the fact that the merchandise inventory account always shows us the value of inventory that should be on hand (i.e. it is perpetually kept up to date).

As technology becomes more and more widespread and affordable, most businesses have acquired computerized inventory and accounting systems. In fact, some computerized accounting software programs do not even support the periodic method of accounting anymore – only the perpetual!

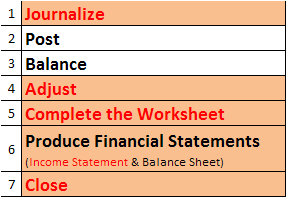

We will learn about the Perpetual Method of accounting for a merchandise business by looking at only what changes between the Periodic Method and the perpetual method. The shaded regions of the accounting cycle shown below indicate the areas of change.

Once more, the two methods differ only when the “costing” of inventory occurs.

Accounts Used in the Perpetual Method

Some of the accounts we used in the Periodic method, are no longer required in the Perpetual method.

The main reason is now we track changes to the merchandise inventory account as they happen. Purchases go directly into the inventory account, and when there’s a sale, the value is taken out of the inventory account and placed into the Cost of Goods Sold expense account.

Click ‘Next’ below to see how the accounts differ between the two methods.

Generally, whenever we would have used any of the accounts listed on the left, we now use Merchandise Inventory.

As well, when we sell goods, we now record the inventory leaving our possession, and record an increase to cost of goods sold (which is now an actual account).

We will now examine the use of these accounts more closely.

(Note: all the following transaction are based on $1,000 of inventory before

tax.)

By now, you may have noticed a trend: when you used to use one of the accounts

shown on the left above (i.e. Purchases, Purchase Returns), now you only use

Merchandise Inventory!

You may have noticed that under the periodic method, when we sell inventory we recorded the sale, but we did not record it being removed from the Merchandise Inventory account.

This is because we don’t keep this account’s value up to date in the Periodic method. . Instead, we track changes using all of the new accounts we saw above on the left. Then we update Merchandise Inventory in the closing entry process.

In the Perpetual method, we continuously keep Inventory values up to date. So when we sell items, we do remove them from the Inventory asset account. Observe:

Note: there is no difference here, as the costing of inventory is not involved. Sales discounts only affect the amount of cash to be received by the customer.

Click below for practice transactions for a perpetual merchandise business. A template for recording the journal entries is included in each file.

NOTE: If you prefer, you can do it by hand. You can print out your own accounting paper at any time by using this file:

![]() Answer

Answer

Click below for the answers to the problems above.